modified business tax return instructions

See Regulations section 11411-3 c for more details and examples. Ad modified tax return.

Tax Planning Strategies Tips Steps Resources For Planning Maryville Online

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU.

. Signature Date 1 to 10 11 to 15 16 to 20 21 to 30 31 15. The statement must provide the names addresses and employer identification numbers EINs if applicable for the activities being grouped as a single activity. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this.

Quick guide on how to complete nevada modified business tax return form. Include a copy of the original return 2. All Major Categories Covered.

The amended return must be filed within the time prescribed by law for the applicable tax year. CARRY FORWARD If Line 5 is less than zero 0 enter amount FEIN of Business Name Above THIS RETURN MUST BE SIGNED FOR DEPARTMENT USE ONLY PERIOD. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY - Use this form only for the quarterly filing period beginning July 1 2009 Financial Institutions need to use the form developed specifically for them TXR-02101 Line 1. If APTC was paid on your behalf or if APTC was not paid on your behalf but you wish to take the PTC you must file Form 8962 and attach it to your tax return Form 1040 1040-SR or 1040-NR. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter.

Write the word AMENDED in black ink in the upper right-hand corner of the return. Blank Forms PDF Forms Printable Forms Fillable Forms. Use the Sign Tool to create and add your electronic signature to signNow the Nevada modified business tax return form.

Now you can print download or share the form. Gross wages payments made and individual employee information. Press Done after you finish the form.

Modified Adjusted Gross Income MAGI. Fill out Modified Business Tax Return General Businesses Form within a few minutes following the recommendations listed below. You must file a written statement with your original income tax return for the first tax year in which two or more activities are originally grouped into a single activity.

The credit may only be used for any of the four calendar quarters immediately. Select Popular Legal Forms Packages of Any Category. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1.

The Nevada Modified Business Return is an easy form to complete. Pick the document template you need from the collection of legal forms. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02105 IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU.

However the first 50000 of gross wages. Employer paid health care costs paid this calendar quarter. PREVIOUS DEBITS Outstanding liabilities AMOUNT PAID 17.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Exceptions to this are employers of exempt organizations and employers with household employees only. Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter.

Line-through the original figures in black ink leaving original figures legible. CARRY FORWARD If Line 5 is less than zero 0 enter amount FEIN of Business Name Above THIS RETURN MUST BE SIGNED FOR DEPARTMENT USE ONLY PERIOD. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this.

On the S portions Form 8960 worksheet enter the S portions net investment income on line 7 of the trusts Form 8960 and combine line 19a of the Form 8960 worksheet with the non-S portions AGI to arrive at the amount on line 19a. MODIFIED BUSINESS TAX RETURN 1. Ad Learn From A Tax Expert Online And File Business Taxes Confidently With TurboTax Live.

MODIFIED BUSINESS TAX Commerce Tax An employer pursuant to NRS 363A and NRS 363B is entitled to subtract from the calculated Modified Business tax a credit in the amount equal to 50 of the amount of the commerce tax paid by the employer. Complete all of the necessary boxes they are yellowish. It requires data and information you should have on-hand.

Use a check mark to point the answer where needed. Enter corrected figures in black ink next to or above the lined-through figures. Signature Date 1 to 10 11 to 15 16 to 20 21 to 30 31 15.

The modified business tax covers total gross wages less employee health care benefits paid by the employer. PREVIOUS DEBITS Outstanding liabilities AMOUNT PAID 17. Click on the Get form key to open it and begin editing.

MODIFIED BUSINESS TAX RETURN 1. Easily Download Print Forms From. The amended return must include any resulting adjustments to taxable income or to the tax liability for example allowable depreciation in that tax year for the item of section 179 property to which the revocation pertains.

Endobj 3 0 obj Type Page MediaBox 0 0 612 792 Parent 1 0 R Resources ProcSet PDF Text ColorSpace 6 0 R ExtGState 9 0 R Font 11 0 R Contents 33 0 R endobj 4 0 obj Type Page MediaBox 0 0 612 792 Parent 1 0 R Resources ProcSet PDF Text ColorSpace 34 0 R ExtGState 35 0 R Font 36 0 R Contents 79 0 R. If you dont however have this information readily available this simple form can end up taking hours to complete. Double check all the fillable fields to ensure full accuracy.

TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction.

Other Income Category 1 2 And 4 Oix Ps Help Tax Australia 2020 Myob Help Centre

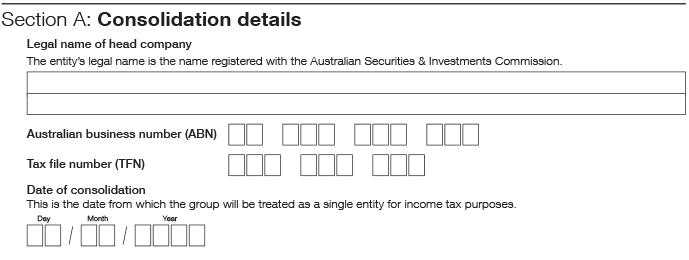

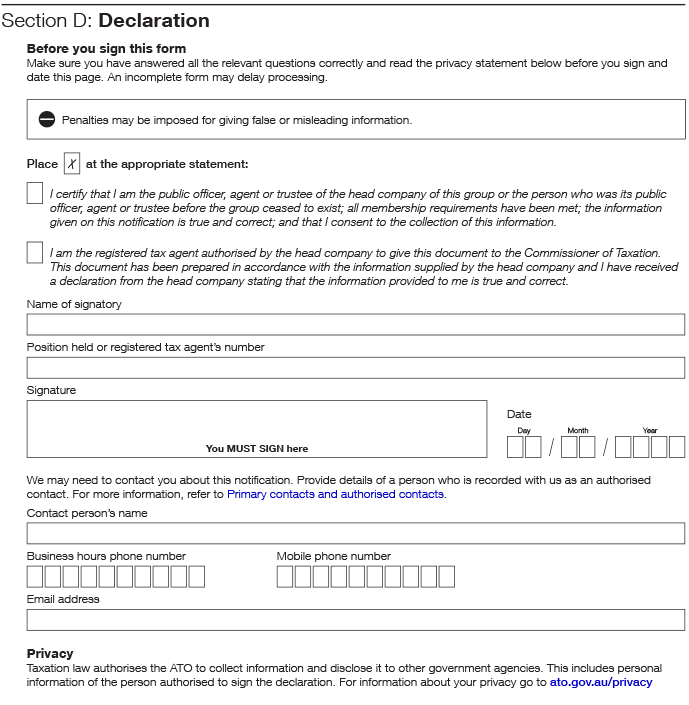

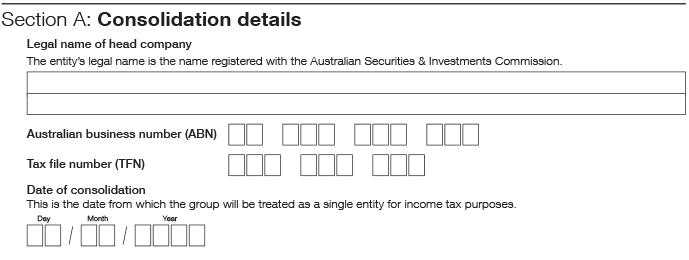

Notification Forms And Instructions Australian Taxation Office

Setting Up Single Touch Payroll Reporting Myob Accountright Myob Help Centre

Zone Tax Offset 2022 Atotaxrates Info

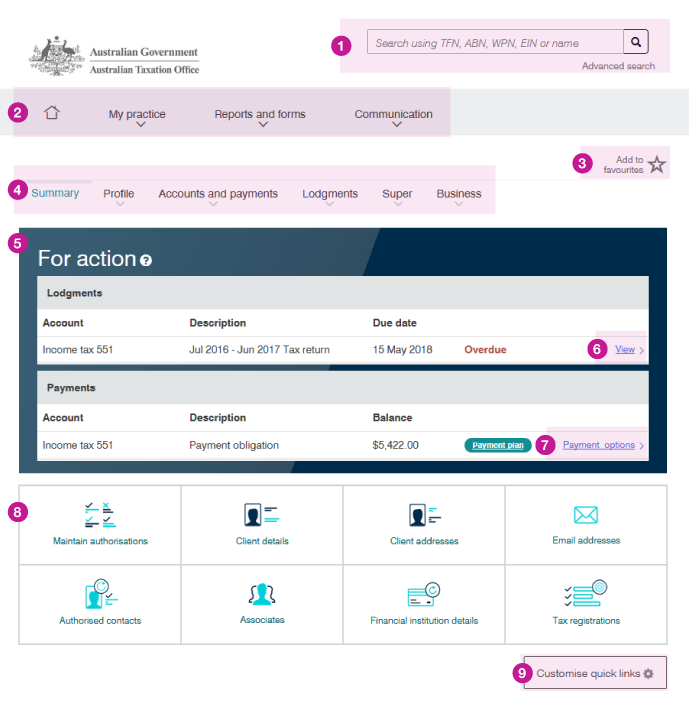

Client Summary Australian Taxation Office

Economic Stimulus Measures Australian Taxation Office

Downloading And Importing Integrated Account From Ato Portal Lodgeit

Franking Credit Refund 2022 Atotaxrates Info

Zone Tax Offset 2022 Atotaxrates Info

Lump Sum E Payment Tax Offset 2022 Atotaxrates Info

Notification Forms And Instructions Australian Taxation Office