capital gains tax increase 2021 uk

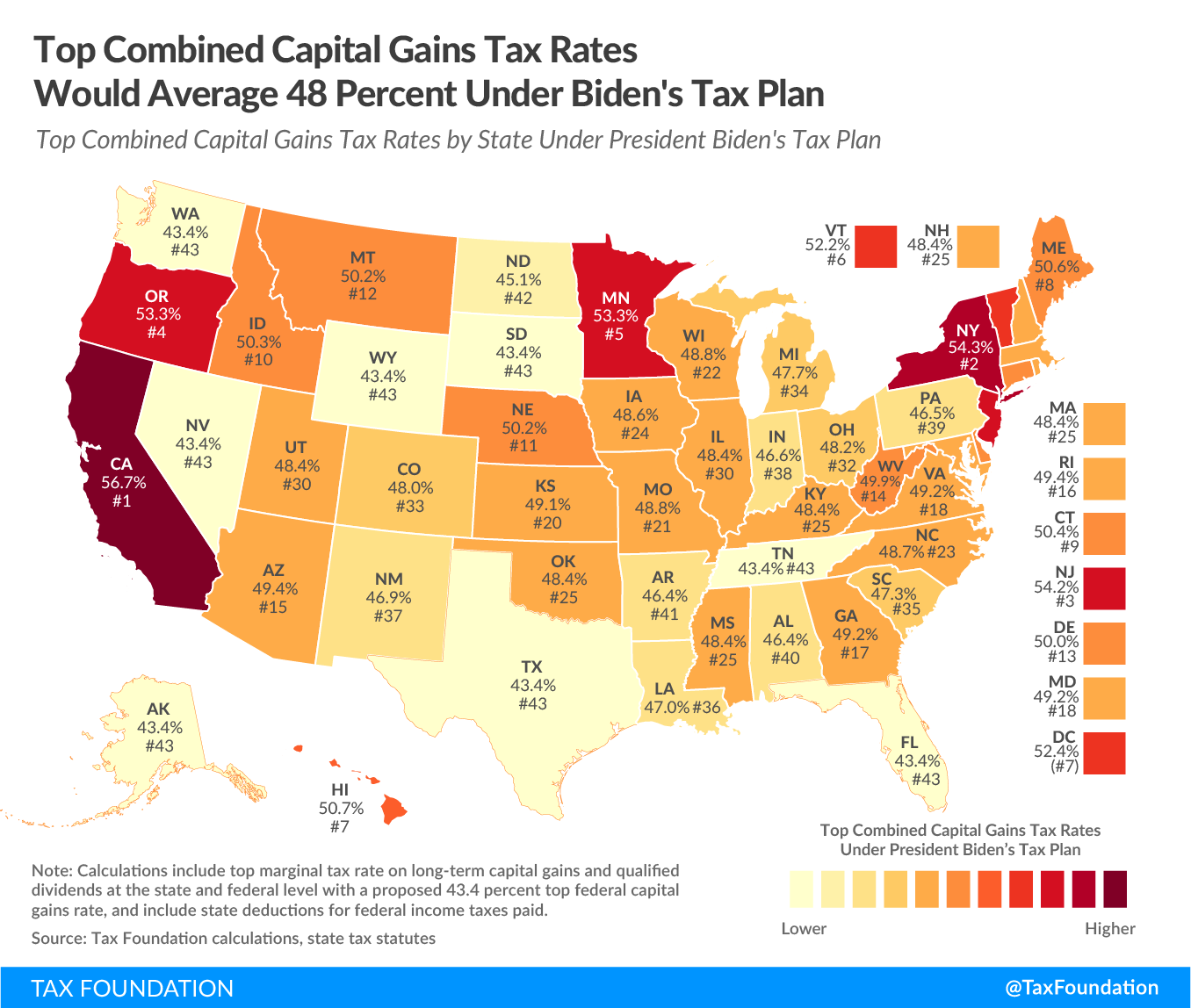

For the 2021 to 2022. Business acquisitions accelerate in response to President Bidens plan to.

Capital Gains Tax Changes In 2021 Budget To Come Into Force Personal Finance Finance Express Co Uk

The two biggest tax-cutting Conservative Chancellors in.

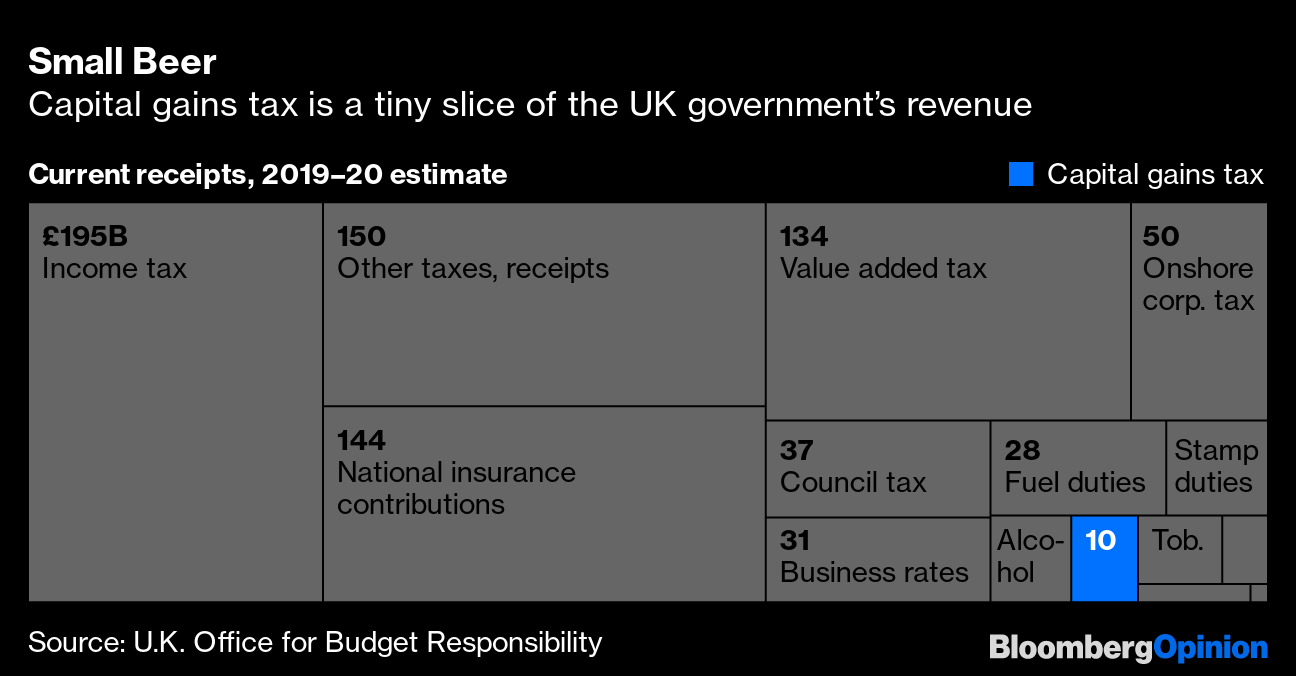

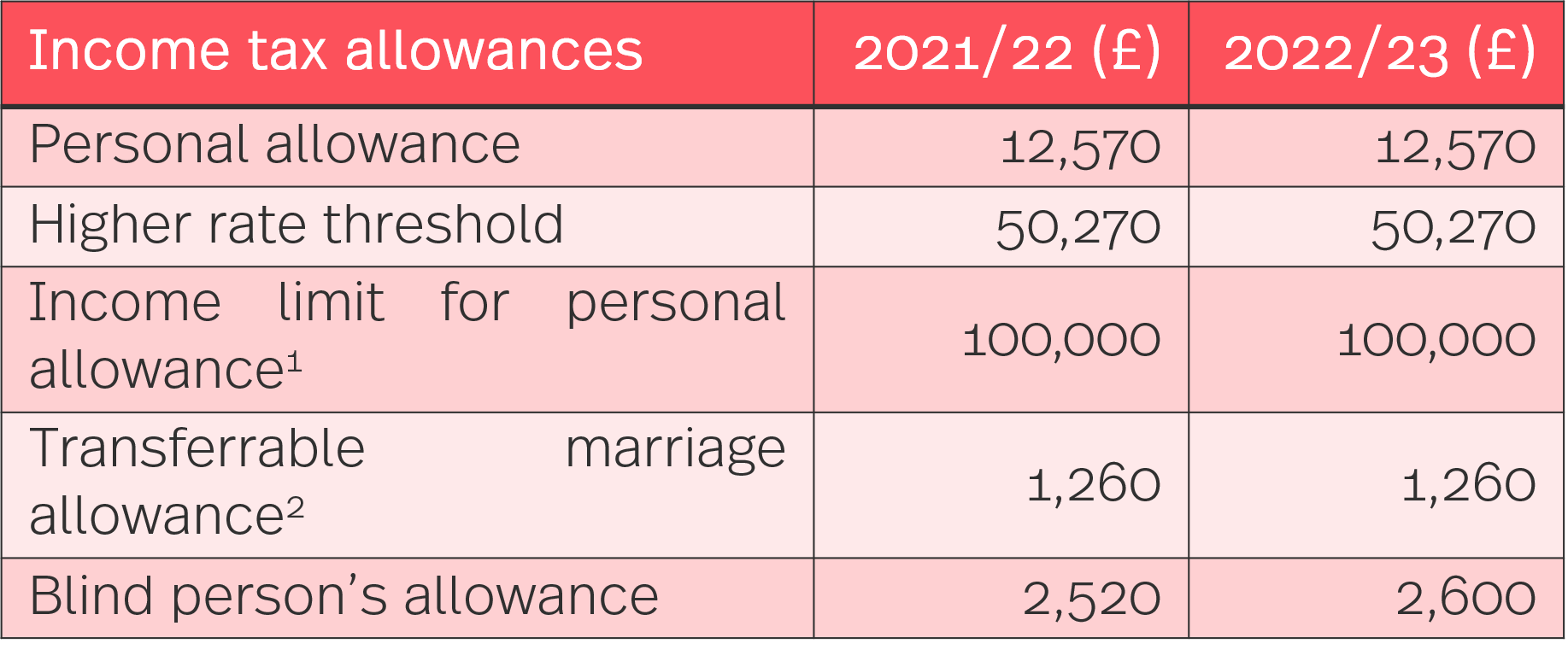

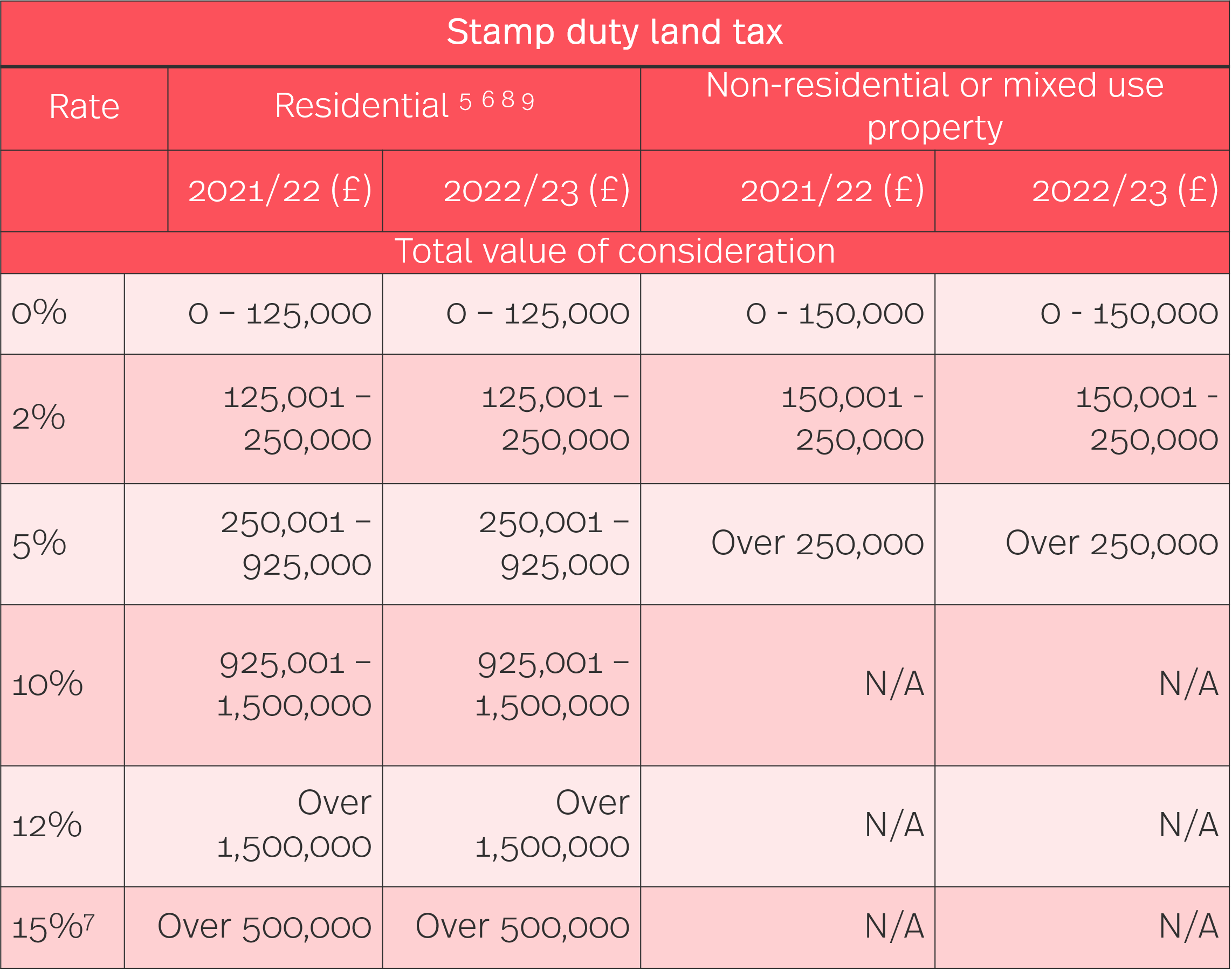

. 10 18 for residential. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay. This could result in a significant increase in CGT rates if this recommendation is implemented.

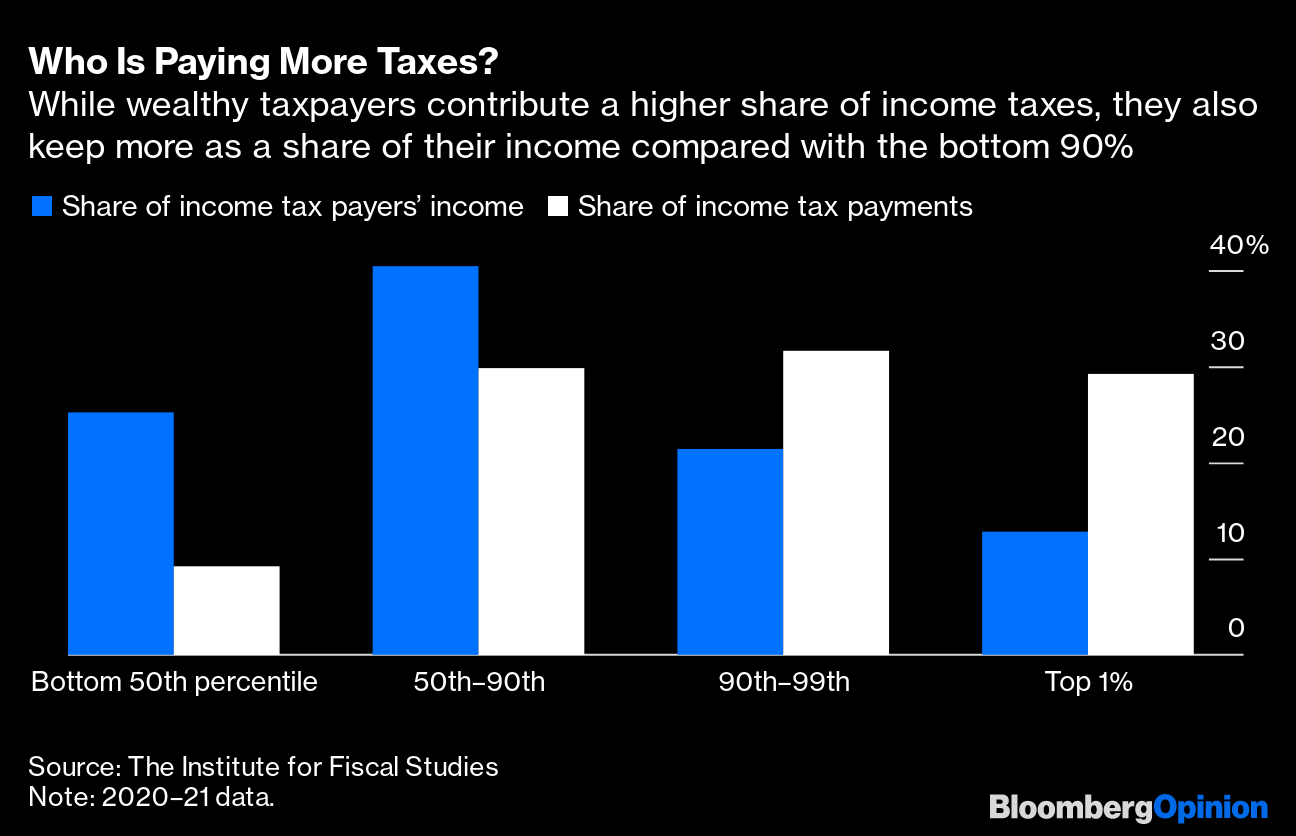

Aligning rates of CGT to income tax levels. Capital Gains Tax rates in the UK for 202223. The Chancellor has long been rumoured be considering bringing capital gains.

Contact a Fidelity Advisor. Capital gains tax increase 2021 uk Sunday February 27 2022 Edit. Well pair you with a certified accountant who can chat through your questions and options.

Ask Question Asked 1 year ago. UK Capital Gains Tax Increase. Reducing the annual gains.

First deduct the Capital Gains tax-free allowance from your taxable gain. Originally intended to be presented during. What is the dividend tax rate for 2021.

CAPITAL GAINS TAX is likely to increase and there could be major. 2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019. Ad Find capital gain tax in Nonfiction Books on Amazon.

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. UK residents currently have to pay capital gains tax within 30 days of completing the sale. The Times reports that the Chancellor is considering an increase in the.

As announced at Budget the government will introduce legislation in Finance. February 22 2021. 40 Annual exempt amount UK.

Capital gains tax. The dividend tax rates for 202122 tax year are. It is thought that.

CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent. Section 1L of TCGA 1992 which. Capital gains tax UK.

Currently there are four rates of CGT between 10 and 28. The maximum UK tax rate for capital gains on property is currently 28. Ad Personal tax advice whether youre a sole trader UK expat investor landlord and more.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an.

Difference Between Income Tax And Capital Gains Tax Difference Between

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

Capital Gains Tax In The United States Wikipedia

The Complete Guide To The Uk Tax System Expatica

Us Stocks Tesla Capital Gains Tax Shock And Small Cap Guru Interview

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Tax Advantages For Donor Advised Funds Nptrust

Real Estate Capital Gains Tax Rates In 2021 2022

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

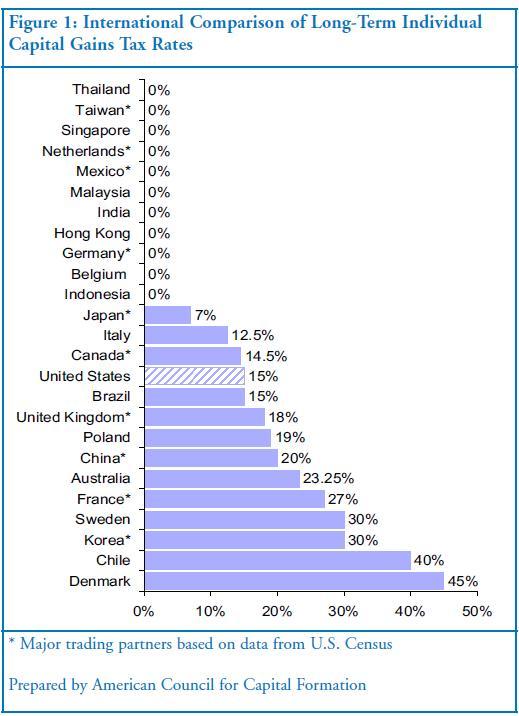

The Overwhelming Case Against Capital Gains Taxation International Liberty

Will Capital Gains Tax Increase What The Property Tax Is And Why Rate Could Change In The 2021 Budget Today

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

Crypto Tax Uk Ultimate Guide 2022 Koinly

Obama Should Leave The Capital Gains Tax Rate At 15 Seeking Alpha

How Much Is Capital Gains Tax Cgt Rates Explained And Budget Proposal Nationalworld